From Warehouse to Boardroom - The Story of TradeHub 21

- adt

- Jan 27

- 8 min read

Rare 3-Storey Terrace Units

When I first stepped into TradeHub 21 several years ago, the sight that struck me wasn’t just the rows of ramp-up units or the familiar hum of forklifts. It was the terrace units, three-storey, self-contained spaces with trucks parked right outside, that stood out.

They reminded me of a hybrid between the practicality of an industrial warehouse and the pride of a corporate office. Over the years, I’ve watched how these spaces became the launchpads for SMEs, e-commerce players, and even family-run businesses that needed more than four walls and a roof.

TradeHub 21, situated along Boon Lay Way at 8, 16, 18, 20, 22, 24, 26, and 28, has established itself as a landmark in Singapore’s west.

For anyone considering a terrace unit here, it isn’t just about buying space. It’s about understanding how this estate fits into a larger story, one of business resilience, strategic positioning, and the ongoing transformation of Jurong.

A Development with Roots in the 2000s

When TradeHub 21 was completed in the early 2000s, it was marketed as a forward-thinking

B1 industrial development in Jurong. Built on a 60-year lease from 2003, it embodied a vision of creating flexible and integrated workspaces for small and medium-sized enterprises (SMEs) seeking long-term growth.

At that time, Jurong East was still primarily a regional centre, with suburban malls and transport links serving the west. The idea of transforming it into Singapore’s second Central Business District was in its early planning stage, an ambition that would later take shape under the Jurong Lake District (JLD) master plan.

For many pioneering companies, moving into TradeHub 21 terrace units meant more than just securing industrial floor space. It was a strategic foothold in western Singapore, close to ports, major expressways like the AYE and PIE, and a growing customer base. Early buyers often remarked on how these units uniquely combined warehouse efficiency with a professional corporate frontage, a rare feature at a time when most industrial properties in Singapore were purely functional in design.

What Makes Terrace Units Special

Among the various configurations, the 3-storey terrace units have always been the crown jewels. Each one typically spans 4,800 to over 6,000 square feet, spread across three functional levels.

On the ground floor, high ceilings (about 6 metres) allow racking, forklift manoeuvres, or bulky storage.

The second level often blends operational use with showroom space. Some businesses utilise it for light assembly, while others establish a client-facing area.

At the top level, you’ll usually find offices. Compliance with the 60/40 office-to-production rule provides companies with the necessary corporate space without violating B1 guidelines.

Add to this direct vehicular access, trucks and even 20-foot containers can park right outside, and you see why buyers favour these units over standard ramp-up factories. For many, it feels like running a standalone building but within a managed estate.

A Day in the Life at TradeHub 21

One of my clients, a second-generation logistics operator, moved into a TradeHub 21 terrace unit about five years ago. Previously, his operations were split between a warehouse in Tuas and a small office in town, a setup that drained both time and efficiency.

By consolidating into a single three-storey terrace, he transformed the way his business operated. In the mornings, delivery trucks roll directly to his loading bay, where goods are quickly sorted thanks to the ground floor’s high ceilings and efficient layout. On the upper levels, his staff manage orders and administration from an open-plan office overlooking the activity below. When clients visit, they step into a space that resembles a professional corporate office rather than a warehouse.

“It gives us credibility,” he once told me. “When partners see our set-up here, they know we are serious players.”

This experience is not unusual. Across TradeHub 21, e-commerce sellers, engineering firms and creative studios have discovered how the terrace configuration allows them to run warehouse, showroom and office operations seamlessly under one roof. It is a practical model that enhances efficiency while also elevating business image, a combination many buyers today are actively seeking.

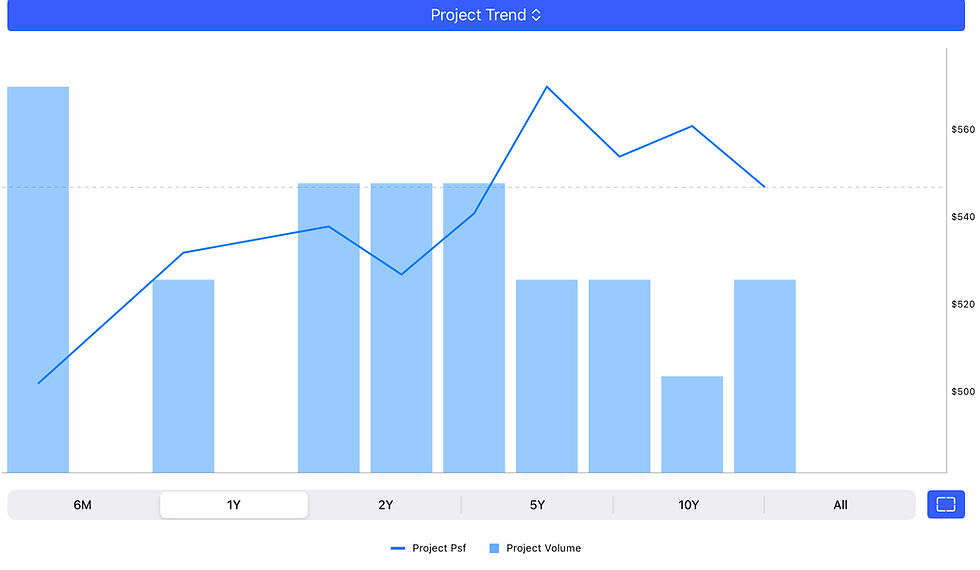

The Numbers Behind the Narrative

Beyond the day-to-day stories of how businesses operate here, the market data provides a clear picture of value. Strata sales of TradeHub 21 terrace units have recently averaged $500 to $580 per square foot. For a unit of approximately 5,000 square feet, this works out to be around $2.5 to $2.9 million, depending on the unit’s location within the estate and the standard of its fit-out.

On the leasing front, terraces command between $2.00 and $2.60 per square foot per month, which works out to monthly rents of $10,000 to $13,000 for a typical unit. These rates reflect both the functional design of the terraces and the scarcity of such configurations in the industrial market.

Scarcity is the key theme here. Very few strata-titled estates in Singapore offer three-storey terrace layouts with direct loading access, and most owners prefer to hold onto their properties in the long term rather than sell. This limited supply, combined with steady occupier demand from logistics, e-commerce, and SMEs, underpins values even as broader market cycles fluctuate.

The conclusion is clear. TradeHub 21 terraces represent a niche that continues to attract both occupiers and investors, offering a rare blend of operational efficiency and investment resilience.

Connectivity and the Jurong Advantage

Location is another part of the story. TradeHub 21 is situated at the intersection of major arteries, including the AYE, PIE, and West Coast Highway. For logistics companies, this means efficient access across the entire island. For staff, Jurong East MRT and a network of bus services provide convenience.

What excites many buyers today is the transformation taking place through the Jurong Lake District (JLD) and Jurong Innovation District (JID). Together, these master plans are shaping the West into a dynamic hub for business, research and lifestyle, with a future vision of a second CBD complete with offices, hotels, housing and R&D facilities, all within minutes of TradeHub 21.

For businesses setting up in the estate’s terrace units, this transformation brings clear advantages. Being located within this growth corridor means stronger client access, a broader talent pool, and the opportunity to tap into new industries and partnerships as Jurong develops into a powerhouse district.

Risks, Realities, and Due Diligence

Every industrial property investment deserves careful evaluation and consideration. For TradeHub 21's terrace units, one of the first factors buyers consider is the remaining lease, 38 years as of this year. In today’s market, that tenure is a strength rather than a weakness.

Under the current Industrial Government Land Sales (IGLS) programme, most new sites are launched with leases of only 20 or 30 years. Against that backdrop, TradeHub 21’s balance lease offers buyers nearly an extra decade, or in some cases almost double the tenure, compared to many new projects.

This longer runway makes financing easier, provides stronger value retention, and gives businesses greater certainty when planning for operations, expansion, or eventual resale. In short, what might seem like a countdown clock is actually a strategic advantage, setting these terrace units apart in Singapore’s industrial property landscape.

Lease Advantage at a Glance

TradeHub 21 Terrace Units: 38 years balance lease (as of this year)

New IGLS Sites: 20 or 30 years from day one

What this means: TradeHub 21 terraces offer buyers longer tenure security, stronger financing options, and better value retention compared to many new industrial launches.

Why TradeHub 21’s 38-Year Balance Is Attractive

Against this backdrop, TradeHub 21’s balance of ~38 years looks favourable:

Almost double the lease of many new 20-year IGLS sites, giving buyers longer operational certainty.

Significantly more than the typical 30-year IGLS site, positioning TradeHub terraces as more secure for both end-users and investors.

Longer leases make it easier to secure financing, attract tenants, and sustain resale demand compared to newer but shorter-tenure industrial projects.

In practical terms, a buyer entering TradeHub 21 today secures an asset with a lease horizon stretching into the early 2060s, while many brand-new IGLS sites tendered in 2025 will expire in the 2040s or 2050s.

Operational Realities Still Matter

Of course, beyond tenure length, buyers should examine the operational aspects of any industrial property closely. For TradeHub 21 terrace units, several key considerations stand out:

MCST Policies

Clear rules on container access, loading bay allocation, and renovation (A&A) approvals ensure smooth daily operations. Buyers often underestimate how crucial these are until they move in. A well-managed estate like TradeHub 21 provides clarity and consistency, reducing disruptions for businesses that rely on efficient goods movement and custom fit-outs.

Regulatory Compliance

Every industrial property must adhere to fire safety codes, noise and emissions guidelines, and the B1 zoning (60/40 rule). While this sounds restrictive, it actually protects estate value by preventing unsuitable trades from moving in. For buyers, this means the environment surrounding your terrace unit remains stable, professional, and aligned with clean, light industrial use.

Financial Planning

Even with a healthy 38-year balance lease, savvy buyers plan with a clear-eyed view of Singapore’s leasehold system. For industrial land, the government is not obligated to grant lease renewals, and many sites under the IGLS programme are released today with tenures of only 20- or 30-years.

What this means for buyers of TradeHub 21 terrace units:

The longer lease balance compared to new IGLS sites provides more security and flexibility in the near to mid-term.

With more than 30 years remaining, most banks and financial institutions continue to view these units as financeable and bank-friendly, supporting both purchases and refinancing.

From an investment perspective, planning ahead with an exit strategy, whether through rental income, business use, or resale, ensures the unit remains liquid and attractive to the next owner or occupier.

In short, while renewal is not guaranteed, the existing 38-year tenure positions TradeHub 21 terraces as stronger, longer-dated assets than many newer launches, providing buyers with a valuable operating runway and confidence.

Why This Matters to Buyers

Put simply, these “operational realities” are not hurdles; they are guardrails that help protect your investment. At TradeHub 21, buyers benefit from:

A well-structured estate environment, where policies promote efficiency.

Zoning safeguards that protect long-term value.

Financing flexibility, since banks are generally comfortable lending on assets with leases above 30 years.

In today’s market, where many brand-new IGLS sites launch with only 20–30 years from day one, TradeHub 21 offers not only scarcity and functionality but also operational stability and tenure security that appeal to both occupiers and investors.

Looking Ahead

What will TradeHub 21 look like in another decade? If history offers clues, it will remain a bustling estate, its terraces housing businesses that blend grit with ambition. As Jurong grows, so too will the profile of its owners and tenants.

For buyers today, the story is about timing: securing a scarce product in a market that values operational flexibility and location. These units aren’t just square footage; they are spaces where companies write their own growth chapters.

Closing Thought

TradeHub 21’s terrace units don’t need hard selling. Their track record speaks through the businesses they’ve housed, the investors who’ve held them, and the transformation happening right outside their gates. For those who believe in spaces that balance function, image, and potential, the terraces at TradeHub 21 tell a compelling story worth considering.

Curious how a TradeHub 21 terrace unit could support your next phase of growth? Let’s have a conversation and walk you through the possibilities.

About the Author

Amanda began her journey in the real estate sector in 2013. Throughout her career, Amanda has showcased her expertise in various properties.

Her holistic approach and varied experience give her an advantage in understanding the intricacies of different property types.

If you're looking for insightful advice on property matters, Amanda is eager to engage in a meaningful, no-obligation conversation!

Comments